An Unbiased View of Wake County Bail Bonds

How Bail Bonds Raleigh can Save You Time, Stress, and Money.

Table of ContentsThe Ultimate Guide To Bail Bonds Raleigh NcA Biased View of Wake County Bail BondsOur Bail Bonds Raleigh North Carolina StatementsGetting My Wake County Bail Bonds To Work

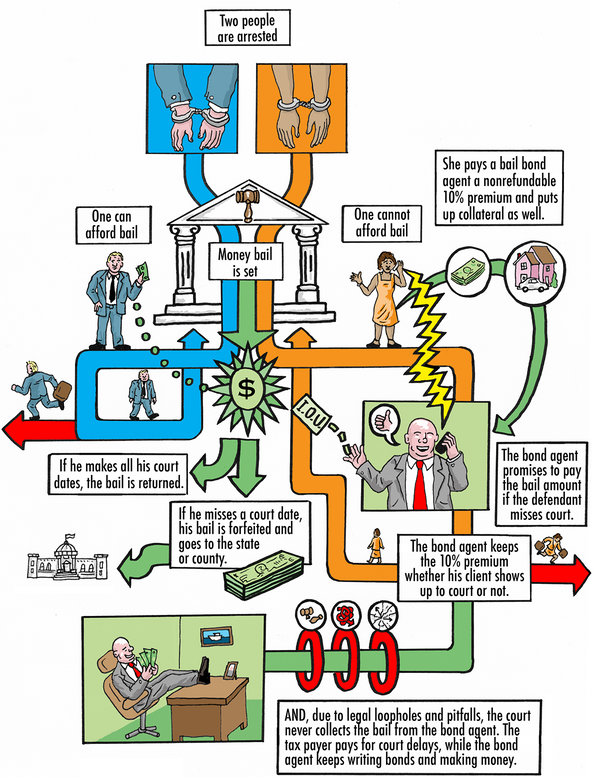

A person that has actually been arrested and charged with a crime might be called for to upload bond (bond) before being released from prison. A bond is insurance to guarantee a defendant will certainly show up in court as required. If an individual stops working to stand for a court date, the bond may be forfeited to the court and a warrant issued for failing to appear.Bond quantities for certain offenses are predetermined by the courts. If somebody wishes to upload bond and keep the funds in their name, the bond must be paid at the court throughout court hours - wake county bail bonds.

When you purchase a united state cost savings bond, you offer money to the U.S. federal government. In turn, the federal government consents to pay that much cash back later - plus added money (passion).

(efficient July 1, 2012). The insurance companies may, at their discretion, pick not to accept them understanding that the product that was instructed was based on the old regulation and not the brand-new legislation. There will certainly not be a separate test for bond agents. Individuals that wish to market bail bonds will take casualty prelicensing training courses and will take the casualty licensing assessment.

The 7-Minute Rule for Wake County Bail Bonds

Yes, if you have a felony sentence including violation of trust fund or crime of dishonesty, you are needed to use for a waiver from the commissioner to carry out the company of insurance via interstate commerce. There is no time restriction pertaining to the date of a felony conviction.

There will not be a separate test for bond representatives. Individuals that want to offer bail bonds will certainly take casualty prelicensing training courses and will certainly take the casualty licensing examination. There is no such point as bail agent authority. To be qualified to write bond bonds in, Colorado you have to be accredited as an insurance policy producer with the casualty line of authority.

This normally consists of down payments up to the amount of 85,000 per eligible person (however please see details on the FSCS web site on for more details on which depositors and firms are covered by FSCS defense). This implies that depositors who are completely secured by the FSCS will certainly not lose money in a bail-in (or any type of various other type of financial institution failing).

The Best Guide To 5 Bail Bondsman Raleigh Nc

This sets out the order in which investors, lenders and depositors of a firm would receive recoveries must a bank be put into an insolvency procedure (also described typically as a 'liquidation'). In line with the creditor hierarchy, deposits not safeguarded by the FSCS would just be subject to bail-in if losses are so high that subjecting all of the investors and a number of debt-holders to bail-in would not suffice (for further information see web page 19 of the Executing-bail-in-an-operational-guide-from-the-Bank-of-England).

Whilst any type of Home Page owner of shares in a financial institution might experience losses in regard of those shares in bail-in, any deposits they may have with that financial institution would certainly be subject to the levels of protection explained above. Even more details on this topic can be located on the Resolution pages and in the The Financial institution of England strategy to resolution.'The FSCS financial institution protection limit is 85,000 does this mean that no money under the amount of 85,000 would certainly have the ability to be taken under bond in rules or do bail in guidelines over trip the FSCS plan?'The Bank of England, that includes the Prudential Law Authority ('PRA'), functions with the FSCS specifically when we have concerns that a firm goes to risk of failing.

If a company's failing would otherwise result in losses for depositors, the FSCS will protect qualified depositors, approximately 85,000. In some particular circumstances, it can be much more, for instance, if a depositor has actually simply offered a house. Information on FSCS settlement restrictions. It is necessary to keep in mind that a PRA-authorised bank or building culture may utilize several brands.

Information of the banking brand names that share FSCS security.'How secure is the FSCS financial institution protection restriction? If several banks obtain into monetary problems at the very same time, will there suffice money in the system to cover all prospective customers money?'The FSCS is moneyed by levies paid by firms that are authorized by the PRA and the Financial Conduct Authority (wake county bail bonds).

Getting The 5 Bail Bondsman Raleigh Nc To Work

requests got after bond publishing workplace hours or not finished during bond posting hours will be completed on the next company day. If authorized, when will a launch occur? Noncitizens will generally be released by the end of the day after the bond is authorized and the Type I-352 bond contract is signed.